Is Rolex a Good Investment? A Detailed Breakdown

Rolex: Invest or Not To Invest, That is The Question

I get asked all the time “Is Rolex a Good Investment?” So today I decided to answer it once and for all in this blog post. Generally, Rolex watches have been known to appreciate over time, making them a potential financial investment. However, it is not as trivial as simply buying any Rolex you like and waiting for it to appreciate. This blog includes some key points to consider before you decide to make a purchasing decision.

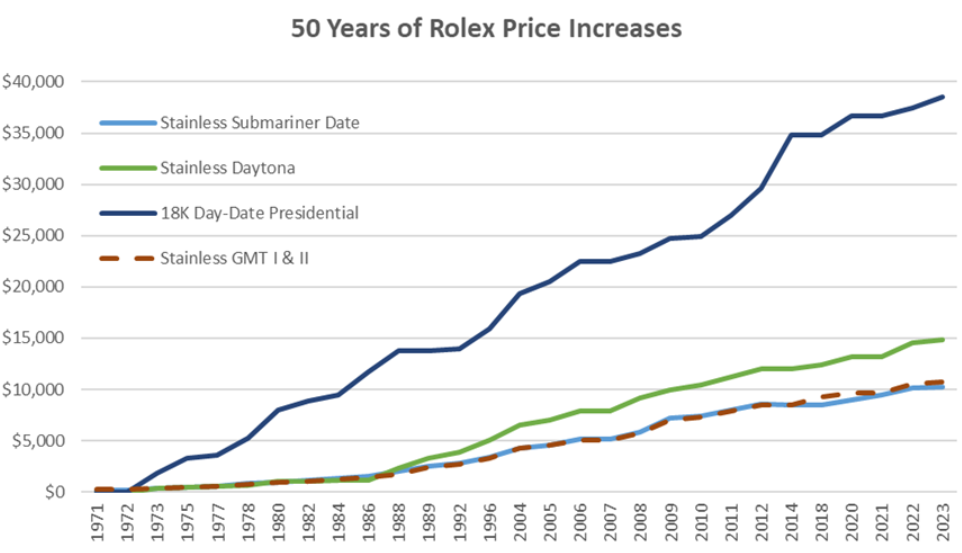

Typical Value Appreciation

Did you know that a pre-owned Rolex watch has significantly outpaced traditional investments like gold, stocks, and real estate? According to Bob’s Watches, the average market price of a pre-owned Rolex surged from 5,000 in 2011 to 13,000 in 2021—a remarkable increase that solidifies Rolex as one of the best-appreciating assets of the past decade.

But the trend goes even further back. Take, for example, the 18K Rolex Day-Date Presidential. Over the last 50 years, this iconic model has demonstrated consistent value growth, with prices tripling since 1992 alone (see Graph 1).

Understanding Concept of Buying Rolexes for Investment

While Rolex watches have proven to be high-performing assets, not every model guarantees a strong return. Some Rolexes are “investment-grade”, while others may depreciate or stagnate in value. The key is identifying watches that are:

✅ Undervalued – Models with prices below their long-term potential.

✅ Recently Discontinued – Short supply often drives demand (and prices) up.

✅ Future Classics – Watches likely to appreciate due to rarity or cultural significance.

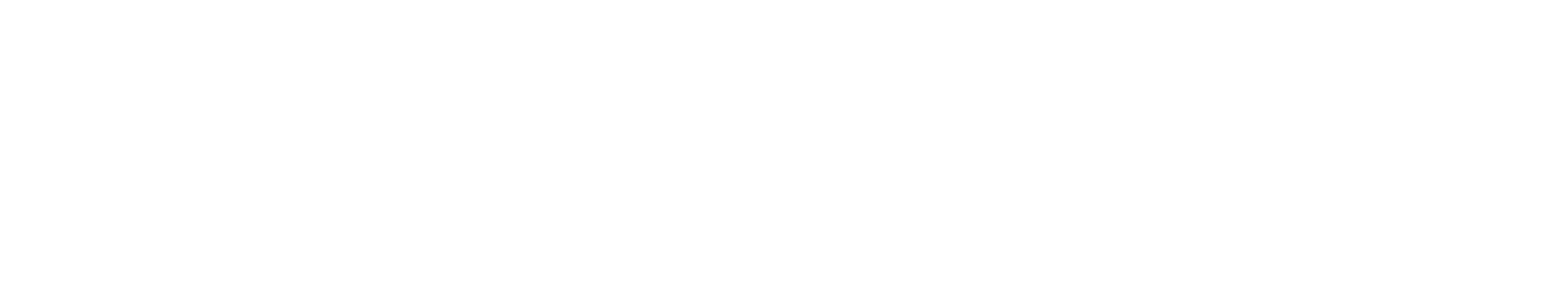

The Rolex Submariner: A Blue-Chip Investment

Among the safest bets is the Rolex Submariner—a timeless icon with consistent value growth. Collectible variants like the:

“Hulk” (Ref. 116610LV) – Discontinued green dial & bezel.

“Starbucks” (Ref. 126610LV) – The modern successor with high demand.

“Root Beer” (Ref. 126711CHNR) – Two-tone luxury with a cult following.

have historically outperformed the market.

For example, the Submariner 114060 (no-date) has appreciated 8-9% annually over the past decade—double the return of today’s best high-yield savings accounts. While slightly below the S&P 500’s average ~10% return, a Rolex offers something stocks can’t: wearable luxury.

Why a Rolex Beats Paper Investments

Tangible Asset – Unlike stocks, you can enjoy it daily.

Scarcity-Driven Value – Limited supply fuels long-term appreciation.

Emotional & Financial ROI – Pride of ownership + profit potential.

Pro Tip: Focus on discontinued, rare, or historically strong models to maximize returns.

The Hidden Risks of Investing in Rolex Watches (And How to Avoid Them)

While Rolex watches can be lucrative investments, they’re not without risks—some unique to the luxury watch market. Here’s what every investor should know before diving in:

1. The “Lifetime Ban” Risk: Flipping Rolexes from Authorized Dealers (ADs)

Rolex strictly prohibits buying from ADs solely to resell.

If caught flipping, you risk being blacklisted from future purchases at official dealers.

Gray market dealers (like us) offer a safer route—no bans, just market-driven prices.

2. Mechanical Wear & Maintenance Costs

Unlike stocks or gold, a Rolex is a precision mechanical device, meaning:

Servicing costs (500−500−1,500 every 5-10 years) eat into profits.

Accidents happen—drops, water damage, or scratches can devalue your watch.

Insurance is a must (1-2% of value annually) to protect your investment.

3. Market Volatility: Buying at the Wrong Time

The COVID-19 boom saw prices double overnight, but the bubble didn’t last. Many who bought Patek Philippes or Rolex Daytonas at peak hype (2021-2022) are still underwater today.

Key Takeaways:

✔ Avoid AD flipping—stick to the gray market for liquidity.

✔ Factor in maintenance—budget for servicing and insurance.

✔ Timing matters—buy during market dips, not frenzied peaks.

Buy What You Love: The Golden Rule of Watch Collecting & Investing

A watch should first and foremost bring you joy. While investment potential matters, personal connection outweighs speculation. Here’s why:

Emotional Value > Market Value – You’ll wear it daily, not just store it. It was created to be worn, this is not an ETF.

Passion Preserves Value – Well-loved watches maintain appeal better than flip targets as you are more likely to take care of it well. Think about it, would you be cleaning, polishing and checking in on a watch you don’t like? Highly unlikely, thus if this is your first investment, buy only what you would you like to see on your wrist.

That being said, if you’re considering Rolex purely as an investment, here are the crucial factors to understand:

1. Sports Models Are Investment Kings

Thanks to Rolex’s legendary sports sponsorships (F1, Wimbledon, golf) and strategic scarcity, professional models like the Daytona, Submariner, and GMT-Master II dominate the secondary market. These icons routinely sell for 2-3x retail price due to:

Multi-year waitlists at ADs

Celebrity associations (think Paul Newman’s Daytona)

Unmatched brand recognition

2. Aftermarket = Automatic Value Drop

While customizations like diamond bezels may look appealing, they destroy resale potential. Purists and collectors only pay top dollar for:

✔ 100% original factory parts

✔ Unpolished cases

✔ Complete box/papers

The Hidden Advantages of Rolex as an Alternative Asset Class

While traditional investments like stocks and bonds dominate most portfolios, Rolex watches offer unique benefits that even seasoned investors often overlook. Let’s examine why high-demand stainless steel Rolex models have quietly become one of the most resilient stores of value in the luxury market.

Borderless Wealth Without Paperwork

One of Rolex’s most underappreciated advantages is its exemption from U.S. international travel reporting requirements. Unlike cash over $10,000 which must be declared to customs, a $50,000 Daytona on your wrist requires no documentation.

This makes Rolex:

• The ultimate discreet wealth transfer tool between countries

• Exempt from FBAR and FATCA reporting requirements

• Immediately liquid in any major city worldwide

Economic Crisis? Rolex Just Shrugs

Historical data shows Rolex prices demonstrate remarkable resilience during downturns:

During the 2008 financial crisis, while the S&P 500 dropped 38%, vintage Rolex values remained stable or increased slightly

The COVID-19 market saw record highs for sports models as investors sought tangible assets

Unlike stocks tied to company performance or ETFs tracking indices, Rolex demand comes from global wealth preservation needs

The Stainless Steel Premium Paradox

Contrary to expectations, the most valuable Rolex models aren’t the precious metal versions:

• Stainless steel professional models (Submariner, GMT, Daytona) consistently trade 2-3x retail

• Gold and two-tone models typically sell at or below retail price in secondary market

• Platinum Rolex watches have particularly poor resale value despite higher retail costs

This occurs because:

Steel models have significantly lower production numbers

Younger collectors prefer the sportier aesthetic

The professional line carries more brand prestige

Maintenance Costs vs. Other Tangible Assets

Compared to alternative hard assets:

| Asset | Annual Costs | Liquidity | Appreciation Potential |

|---|---|---|---|

| Rolex Watch | $200 insurance + $500 service/5yrs | High (global market) | 5-15% annually for steel sports models |

| Rental Property | 1-3% property value + maintenance | Low (months to sell) | 3-5% historically |

| Gold Bullion | Storage fees (0.5-1% annually) | Medium (dealer spreads) | Tracks inflation |

Why Rolex Outperforms Other Luxury Goods

Unlike cars, art, or jewelry which depreciate:

• Rolex systematically limits production to maintain scarcity

• The brand increases retail prices 7-10% annually, pulling up secondary market values

• Global recognition means instant liquidity in any major market

The One Drawback: No Cash Flow

Where Rolex falls short versus traditional investments:

• Unlike dividend stocks or rental properties, watches generate no income

• Requires insurance and occasional maintenance costs

• Best suited as a small portion (5-10%) of a diversified portfolio

Tax Advantages Savvy Investors Use

• In the U.S., watches held over 1 year qualify for long-term capital gains rates (15-20% vs 28% for collectibles)

• Can be included in estate planning with stepped-up basis

• Insurance appraisals help document value for tax purposes

Strategic Buying Tips

For maximum investment potential:

Focus on discontinued stainless steel professional models

Always keep original boxes and papers

Never polish cases or replace original parts

Buy during seasonal market dips (typically late summer)

The most successful Rolex investors treat their watches like blue-chip art – holding for decades rather than flipping quickly. While not without risks, a carefully selected Rolex can serve as both a personal treasure and a surprisingly resilient financial asset.

So where should you start?

Now that you have come to the end of this blog, you have a pretty solid understanding of Rolex’s investment value and whether it is a good investment. So your next logical question can be, “So where do I buy one?”

Well, right here on our website. Atltime (also known as Atlanta Time) is one of the Top Pre-Owned watch resellers in the United States. Simply go to our shop page and find the Rolex you like. To make it even easier for you, I have listed some of our favourite Rolex watches at the bottom of this page, so if you don’t feel like redirecting to shop page, simply scroll down. Happy Shopping!

Our Selection

-

Extended watch CollectionBuy now

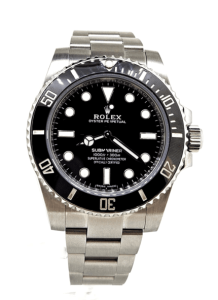

Rolex Yacht-Master 40 Rhodium Grey Dial Platinum Bezel16622

$8,900.00 Add to cartRated 0 out of 5 -

Rolex MenBuy now

Rolex Sea-Dweller 2022 Red Letter 43mm Ceramic Bezel 126600

$12,600.00 Add to cartRated 0 out of 5 -

Extended watch CollectionBuy now

Rolex Datejust 31mm Quickset Midsize 18KGold/Stainless Steel Jubilee Champagne Dial 68273

$5,950.00 Add to cartRated 0 out of 5 -

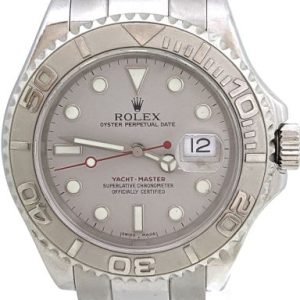

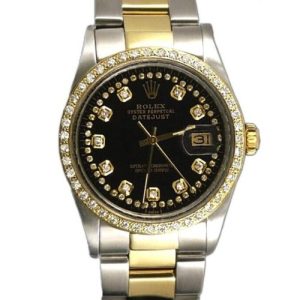

Extended watch CollectionBuy now

Rolex DateJust Mens 36mm Stainless Steel Black Diamond Dial Diamond Bezel

$5,500.00 Add to cartRated 0 out of 5 -

Rolex WomenBuy now

Rolex Ladies DateJust 26mm Yellow Gold Stainless Steel Mother of Pearl Diamond Dial Diamond Bezel

$4,400.00 Add to cartRated 0 out of 5 -

Extended watch CollectionBuy now

Rolex DateJust Mens Stainless Steel/Yellow Gold String Black Diamond Dial Yellow Gold Dimond Bezel

$8,700.00 Add to cartRated 0 out of 5 -

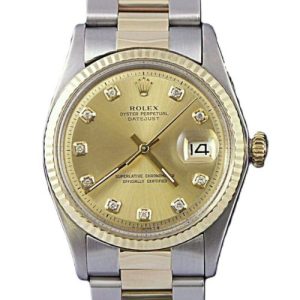

Extended watch CollectionBuy now

Rolex DateJust Mens 36mm Oyster Perpertual Stainless Steel 18K Yellow Gold Gold Color Diamond Dial Fluted Bezel

Rated 0 out of 5$7,900.00Original price was: $7,900.00.$7,600.00Current price is: $7,600.00. Add to cart -

Extended watch CollectionBuy now

Rolex DateJust Mens 36mm Stainless Steel Jubilee String Silver Color Diamond Dial Sapphire Diamond Bezel

$5,850.00 Add to cartRated 0 out of 5 -

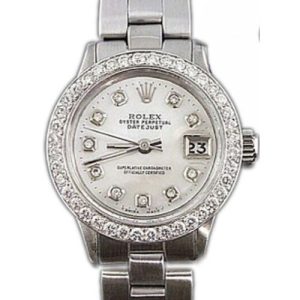

Rolex WomenBuy now

Rolex Ladies DateJust Oyster Style Stainless Steel Diamond Bezel White Mother of Pearl Diamond Dial

$4,088.00 Add to cartRated 0 out of 5 -

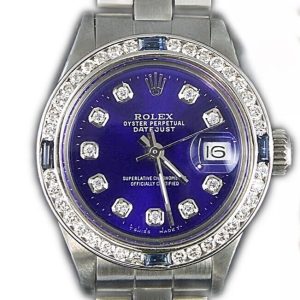

Rolex WomenBuy now

Rolex Ladies DateJust Stainless Steel Oyster Style Diamond Sapphire Bezel Blue Diamond Dial

$4,088.00 Add to cartRated 0 out of 5 -

Rolex WomenBuy now

Rolex Ladies DateJust 26mm Oyster Style Stainless Steel, String Green Color Diamond Dial Diamond Bezel

$4,188.00 Add to cartRated 0 out of 5 -

Extended watch CollectionBuy now

Rolex DateJust 36mm Oyster Perpertual Stainless Steel White Roman Dial 16220

$5,700.00 Add to cartRated 0 out of 5 -

Extended watch CollectionBuy now

Rolex DateJust Mens 36mm Stainless Steel Yellow Gold Pink Floral Diamond Dial Diamond Bezel

$6,400.00 Add to cartRated 0 out of 5 -

Extended watch CollectionBuy now

Rolex Datejust 31mm Stainless Steel Jubilee Style Factory Silver Color Anniversary Diamond Dial

$6,800.00 Add to cartRated 0 out of 5 -

Rolex WomenBuy now

Rolex Ladies DateJust 26mm Oyster Style Stainless Steel Ice Blue Color Diamond Dial Diamond Bezel

$4,088.00 Add to cartRated 0 out of 5 -

Rolex WomenBuy now

Rolex Ladies DateJust 26mm Jubilee Style Stainless Steel Ice Blue Color Diamond Dial Diamond Bezel

$4,088.00 Add to cartRated 0 out of 5